52+ the price-earnings ratio is calculated by dividing:

Market value per share by earnings per share. It is calculated by dividing the.

52 Sample Break Even Analysis In Pdf Ms Word Excel

Web The ratio is calculated by adding up the dividends paid per share over the past four quarters then dividing by the total diluted earnings per share for that period.

. Trailing price-to-earnings PE is calculated by taking the current stock price and dividing it by the trailing earnings per. Let us assume that WallStreetMojo 2016E and 2017E EPS are 4 and 5 respectively. For instance the values for 31st July give the stock price of 9662 and.

Market capitalization by its net income. Earnings Per Share. Web One way to calculate the PE ratio is to use a companys earnings over the past 12 months.

Earning per share can also be expressed as a priceearnings ratio by dividing the current price per share by EPS. Dividends per share by market value per share. Web The price-to-earnings ratio or PE ratio is a metric to express how much investors are paying per every 1 of earnings.

Web The price to earnings ratio can also be calculated by dividing the companys equity value ie. Web Price Earnings Ratio Formula PE Stock Price Per Share Earnings Per Share or PE Market Capitalization Total Net Earnings or Justified PE Dividend. Price to Earnings Ratio PE Equity.

The stock price divided by the EPS gives the PE Ratio value. This is referred to as the trailing PE ratio or trailing twelve month. If you dont know a companys EPS it can be calculated by.

Web The price-earnings ratio is calculated by dividing. Web Trailing Price-To-Earnings - Trailing PE. Web The PE ratio formula is applied.

If this was a. Web WallStreetMojos Target Price EPS WallStreetMojo x Forward PE Ratio. This means that investors are willing to pay 20-25 per 1 of company earnings.

Web Price Earnings Ratio. Web Price Per Share. Web The average PE ratio for stocks hang around the 20-25 mark.

The price-earnings ratio is calculated by dividing. Based on the PE. Calculate PE Ratio Price Per Share Earnings Per Share PE Ratio Price to Earnings PE Ratio is calculated by dividing the.

Market value per share by dividends per share. Earnings per share by market value per share. Web The PE ratio is calculated by dividing the market price of one share by the companys EPS.

Price To Earnings Ratio In Stocks Meaning Formula Calculation Gainy

Price To Earnings Ratio In Stocks Meaning Formula Calculation Gainy

A Central Role For P48 45 In Malaria Parasite Male Gamete Fertility Cell

How To Calculate Price Earnings Ratio 7 Steps With Pictures

Price To Earnings Ratio In Stocks Meaning Formula Calculation Gainy

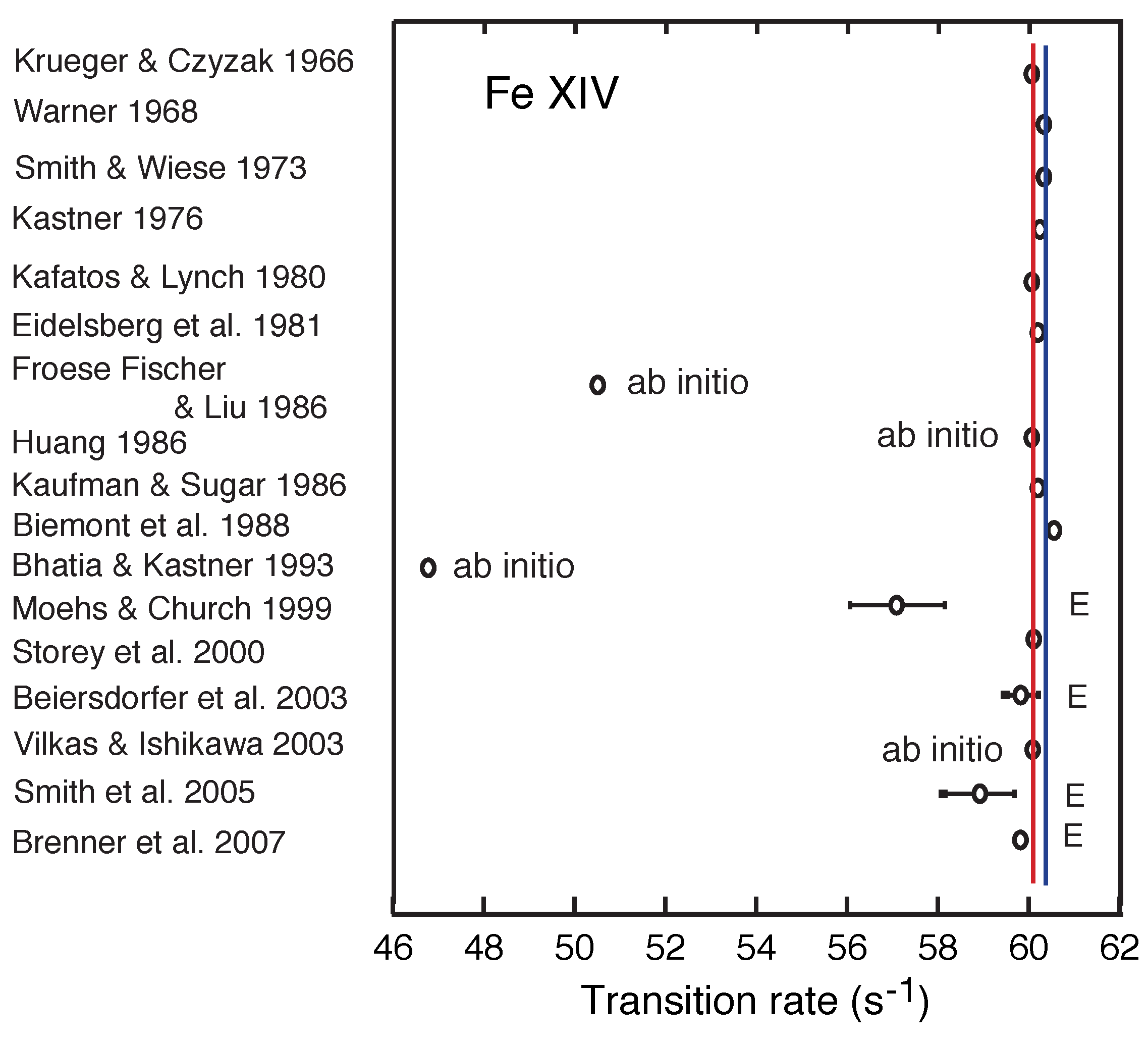

Atoms Free Full Text Critical Assessment Of Theoretical Calculations Of Atomic Structure And Transition Probabilities An Experimenter S View

Price To Earnings Ratio In Stocks Meaning Formula Calculation Gainy

Is The Price Earnings Ratio P E Obsolete Nuggets Of Investing Wisdom

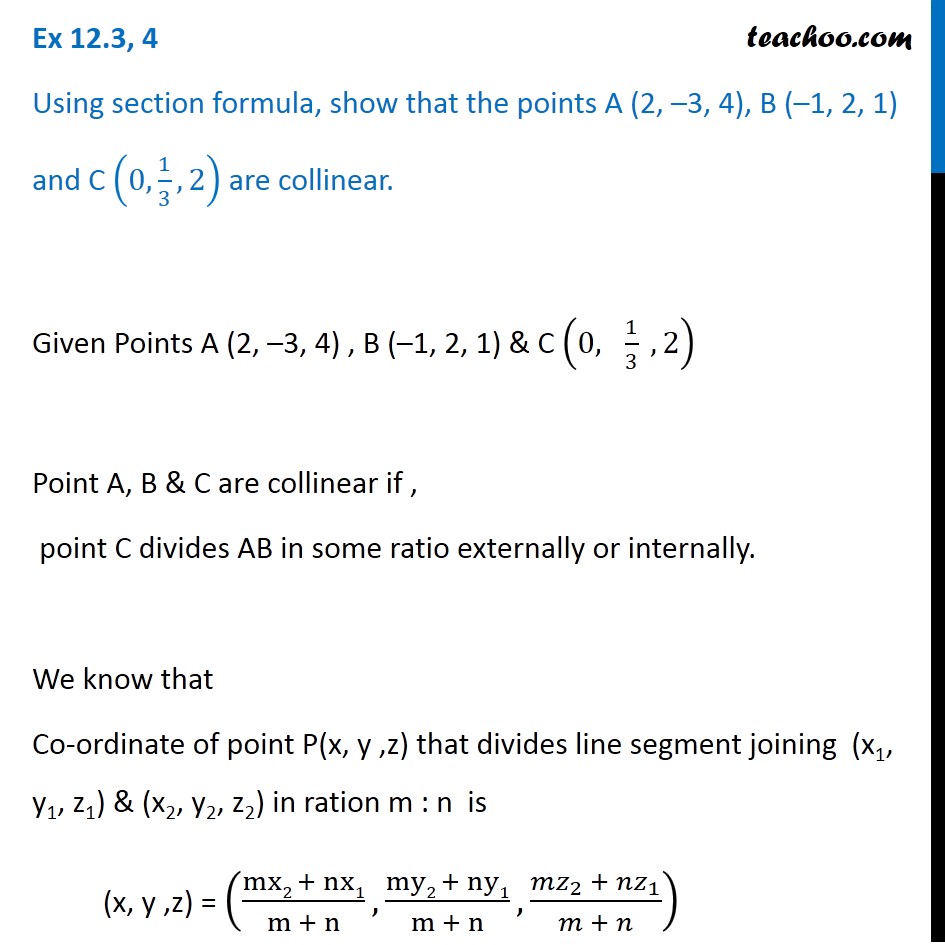

Ex 12 3 4 Using Section Formula Show That Points A 2 3 4 B

What Is The Price To Earnings Ratio The P E Ratio Speck Company

Price To Earnings Ratio In Stocks Meaning Formula Calculation Gainy

All Aboute P E Ratio

Solved I Don T Understand How The Teachers Formula Works If Someone Can Course Hero

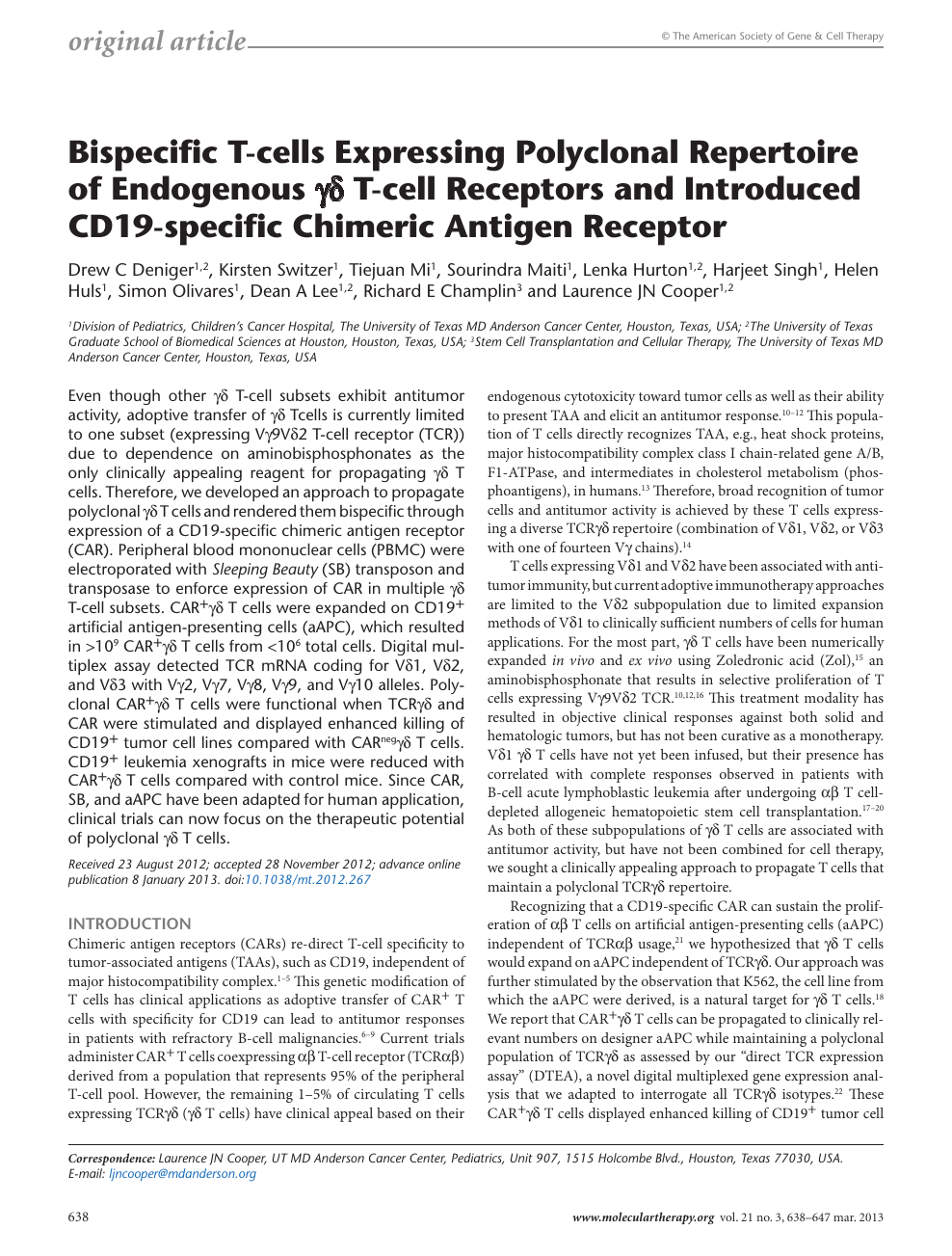

Bispecific T Cells Expressing Polyclonal Repertoire Of Endogenous Gd T Cell Receptors And Introduced Cd19 Specific Chimeric Antigen Receptor Topic Of Research Paper In Biological Sciences Download Scholarly Article Pdf And Read For Free

Price Earnings Ratio Formula Calculation And Interpretation

Price Earnings P E Ratio Explained With Example Youtube

Free 12 Price Earnings Ratio Samples In Pdf Ms Word